According to the

National Retail Federation

, an estimated 165 million shoppers are expected to head out to the stores for Black Friday and Small Business Saturday, making it one of the busiest shopping weekends of the year. Whether you prefer heading to the mall or shopping online, it’s undeniable that this is a great time to save money on holiday shopping.

We have some tips to save money during the holiday season so you can spend less time stressing and more time with your loved ones.

Cut extra costs

Think about one thing that you regularly purchase that you could do yourself. Between car washes, house chores, oil changes, or even subscriptions for meal kits, there is likely something that you could be doing yourself for free.

Even more, try cutting out unnecessary costs in your weekly spending. One easy way to save is to pack your lunch for work this week and save the money you’d spend eating out.

Track online deals

If you’re shopping online for gifts, there are plenty of ways to maximize savings. Explore toolbar extensions that track deals and connect you with rewards programs to save money while also racking up points.

Whether you prefer credit card cash-back rewards or air miles, there is an option for everyone. The

American Airlines

e-shopping browser extension helps you score great deals and rack up points for your next flight. Prefer cash back rewards? Check to see if your credit card has “bonus categories” that you can activate to get a percentage of cash back on select purchases — you can usually find this information on the credit card issuer’s website.

Additionally, make sure that you’re giving yourself time to comparison shop rather than jumping on what looks to be a good deal. You can use a tool like

Google Shopping

to find the best deals from across the web.

Keep in mind that experts recommend limiting your credit card use if possible, and to instead try to use the cash set aside for your holiday budget. When you pay with cash, it’s harder to rack up debt.

Discuss gift expectations early

One way to save money while adding some excitement to the holidays is proposing a change to the gift expectations. Suggest a “secret” gift exchange or mix it up by drawing names rather than buying gifts for every family member. A new tradition can save everyone in the family money while making the gift exchange more exciting.

Get crafty

Rather than ordering greeting cards this holiday season, consider creating your own design on a service like Canva.

Canva

is a free graphic design tool website where users can upload photos and create their own designs. The website provides custom-sized templates for greeting cards, postcards, social media posts, and much more.

You can also learn a new skill like candle-making, painting, knitting, or even researching a family lineage to create a memory book or family tree. There are countless ways to save money with DIY (do-it-yourself) gifts, and a quick search on

Pinterest

can get the inspiration flowing. Add a little sentimental value this season with a handmade gift — it’s a great way to spread joy while sticking to a budget.

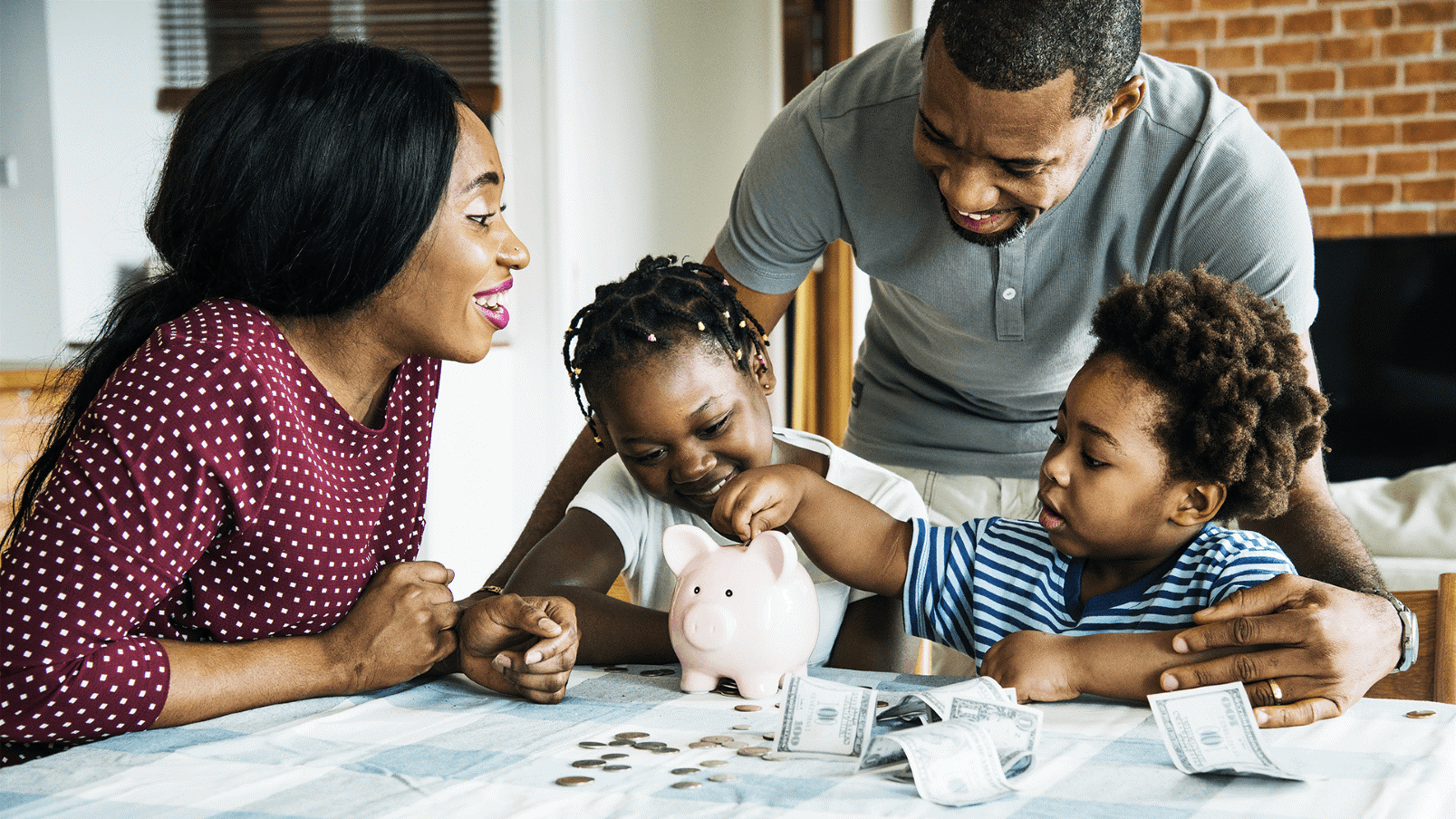

Give the gift of life insurance

If you have a child or grandchild, the gift of life insurance can provide a lifetime of protection and financial support, which will become valuable to them in the future. Symmetry’s

SmartStart program

makes it easy to buy life insurance for children — and it’s surprisingly affordable.

SmartStart not only protects a

child’s financial future

through life insurance, but it also has a cash value savings component that grows tax-free while the policy is in force. Later in life, your child or grandchild can use the cash value for a

college education

, the down payment on a home, or anything they choose.

Since the policy’s growth is indexed to the performance of several different indexes (you get to choose), there is no market risk of loss. The cash value of the policy grows tax-free during the life of the policy and comes with the potential for dramatic growth to give your child or grandchild the head start they deserve.

The bottom line

No matter when you start your holiday shopping, it’s never too late to have some savings tricks up your sleeve. Following the holiday season, these strategies can help you budget and drop a little extra change in your savings account all year long. And when you buy the gift of life insurance for your children or grandchildren, they’ll enjoy financial security and you can have peace of mind in knowing that you contributed to their future success.

Request a Quote for SmartStart

insurance today to protect your loved one’s future for years to come!

This article is written for informational purposes only and should not be taken as financial advice. For a detailed consultation regarding life insurance, please reach out to your Symmetry Financial Group insurance agent.