Do you have a designated person who will finalize your digital assets like your email accounts, subscription services, and take over other items like your camera and cell phone when you pass away? Many of us often forget to plan for our digital assets, and in many states, some laws could prevent our loved ones from shutting down certain social media accounts or emails without permission.

That’s where your digital estate plan can make all the difference. And with a little extra attention, you can connect your digital estate plan with your will and end-of-life plans to make things easier on your loved ones when you’re gone.

What is a digital estate plan?

Similar to a will, a digital estate plan provides instructions for how your digital assets are handled after you die. These assets consist of all your belongings that are stored electronically: photos, videos, important files, documents, and data you’ve stored online. Your computer, cell phone, tablet, digital cameras and external hard drives are also part of your digital estate.

How to create a digital estate plan

The first step to create a digital estate plan is to make a comprehensive list of all your digital assets. Create a list of the different types of assets you own using a spreadsheet or text editor to organize this information.

Protecting your personal assets

Your personal digital assets can include entertainment, music and film purchases, e-books, digital box sets, and any type of media that you’ve purchased online. Don’t forget to include login information for subscription services, such as Netflix or Hulu, in which your beneficiary will need to go in and shut down the account, so it doesn’t continue billing.

Protecting financial digital assets

Your financial digital assets include bank accounts, credit cards, store credit cards, PayPal or money transfer accounts, and any bitcoin or cryptocurrency you own. This also includes loyalty points, store credits, or online shopping websites where you have a user login. You’ll want to list out login information to these sources so your beneficiary can go into these accounts and shut them down or transfer funds.

Protecting physical assets

Your technical digital assets include physical devices such as computers, laptops, cell phones, tablets, e-readers, music players and more. This can also include web domains that you own, blogs you manage, or any trademarks licensed in your name.

Organizing your passwords

The average internet user has about

130 online accounts

– and many of us recycle the same one or two passwords repeatedly. Whether you have the same few passwords for everything, or you’re using a password manager, you’ll want to organize your online accounts and store proper logins in one secure location for your beneficiary. This will save your loved ones a lot of stress and can ensure that your recurring billing subscriptions are shut down properly when the time comes.

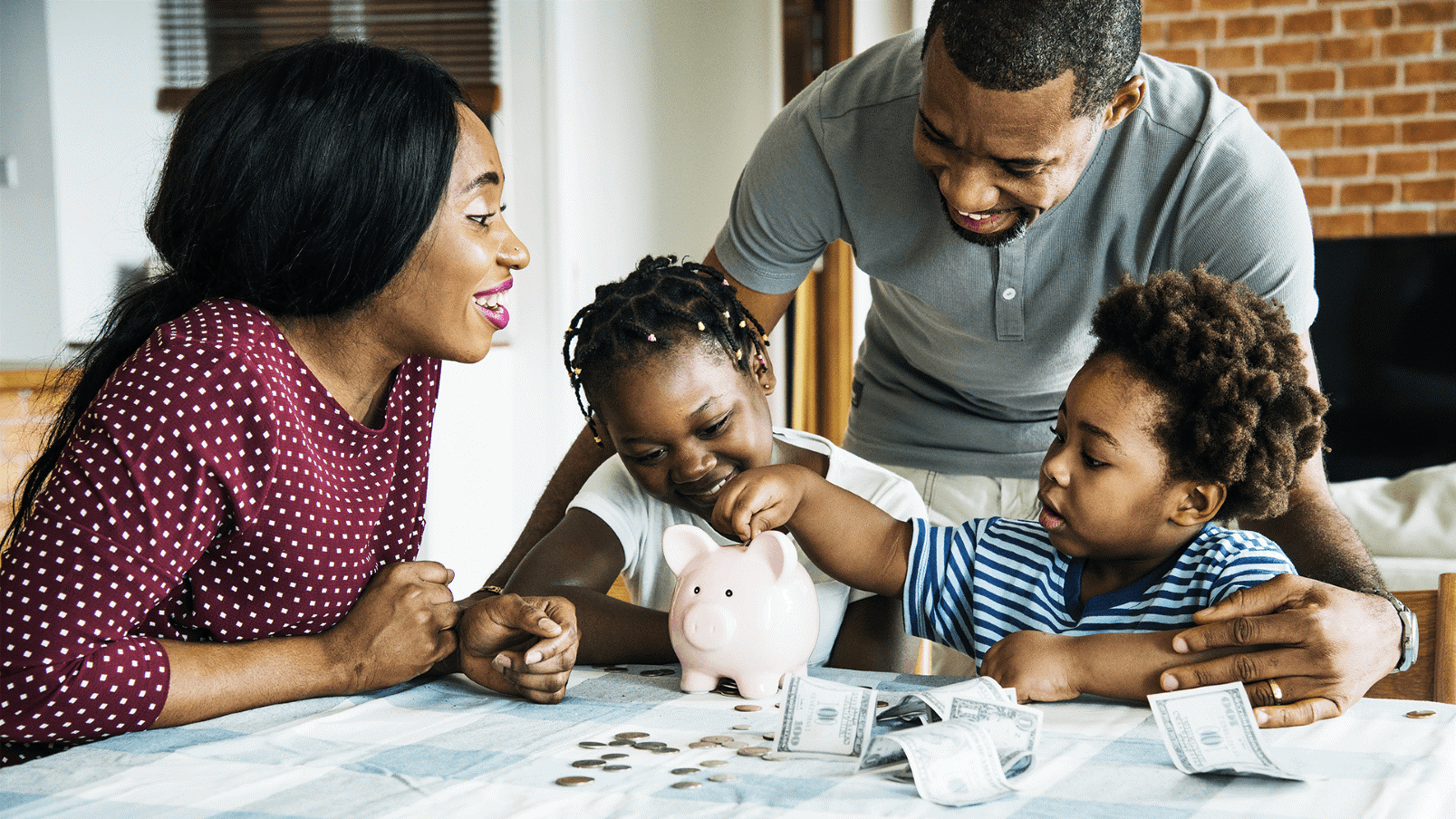

Decide how you want your assets handled + choose a trusted person

Once you’ve gathered your list of digital assets, you’ll want to choose a trusted person to take over your digital estate when the time comes. This should be someone you trust to not only finalize your estate but to close all of your digital properties correctly.

Storing your information

The most important part of building your digital estate is storing it in a secure location where your beneficiary can find it when they need to recover the information. While you could print everything out and keep it in a safe, storing the information in a digital vault can also be a good option.

Storing your digital estate in a secure online vault ensures that all your information is in one place and that a loved one has access to that information at the time you choose.

Contact your Symmetry agent today to learn more about life insurance options

Get in touch with your Symmetry agent today to learn more about adding

life insurance

to your will.

Request a life insurance quote

today to secure a legacy for your loved ones with term life insurance, mortgage protection insurance, universal life, or one of our many other options.