The person (or people) you name as beneficiaries of your life insurance policy or annuity contract will receive the policy proceeds if you die while the insurance is still in force. You have several options when it comes to naming a beneficiary. You can name one or more people, charitable organizations, a business, a revocable or irrevocable trust, a testamentary trust created in your will or your estate.

The decision about who to name as your beneficiary is often straight-forward. However, there are also some potential pitfalls you should be aware of when it comes to your policy beneficiary. Following these tips can help you make the most of your policy beneficiary designations.

What to do when naming a beneficiary

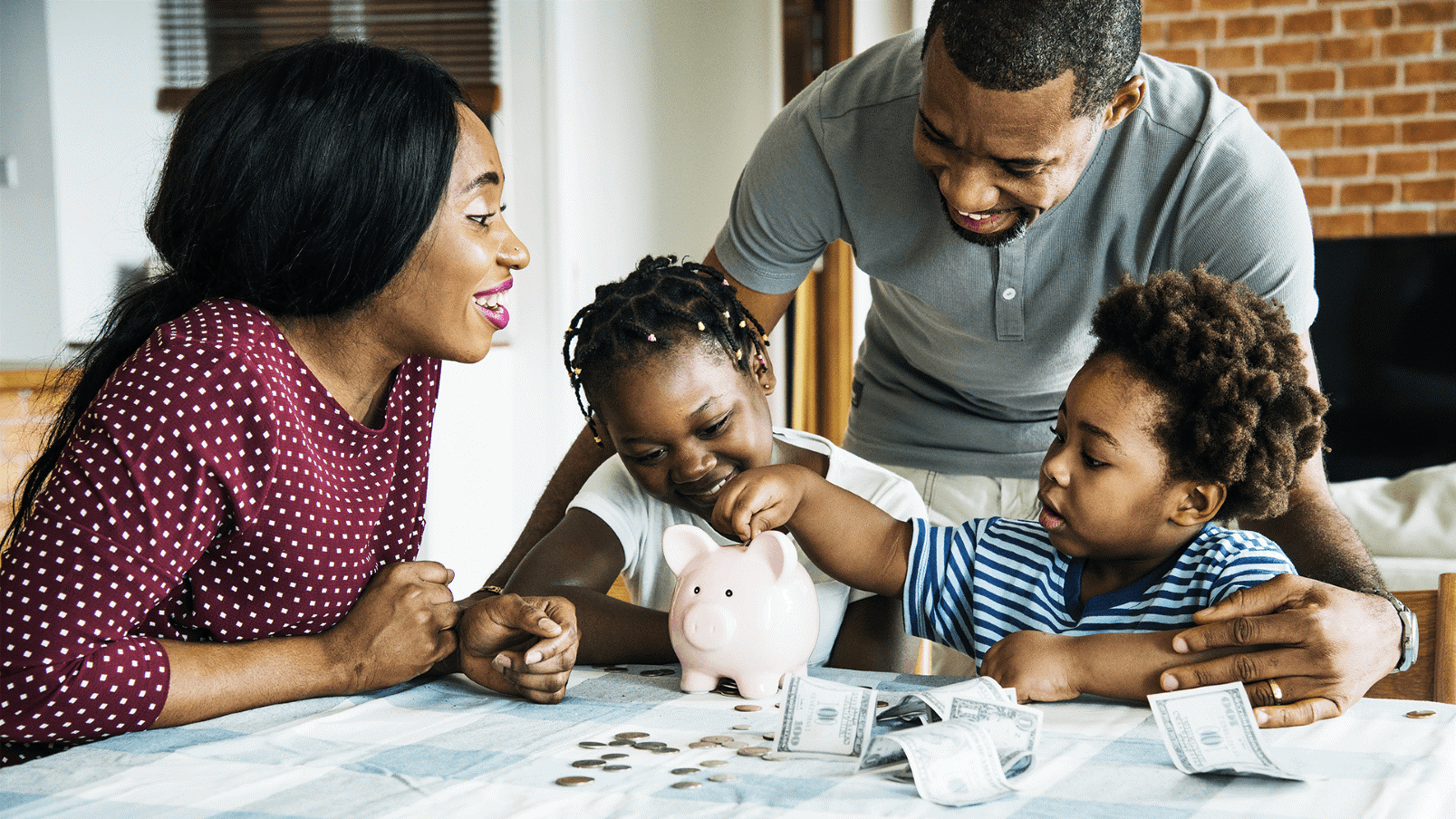

1. Update your beneficiary designations as life events change

Don't take a "set it and forget it" approach to your policy beneficiary. As life events change, it's important to revisit your beneficiary designations and adjust as needed. For example, if you have a policy that pre-dates your marriage, your beneficiaries may be your parents or siblings. If you didn't change the beneficiary and died, the insurance company would be contractually obligated to pay benefits to your named beneficiaries, so your spouse wouldn't receive the policy proceeds. Similarly, if you get divorced and forget to update your beneficiary, your ex-spouse could receive policy proceeds.

2. Understand the difference between "per capita" and "per stirpes" when leaving assets to future generations

If you intend to leave policy benefits to children or grandchildren, you can name multiple beneficiaries and specify that each should receive a certain percentage. Alternatively, you could designate a class of beneficiaries, such as your children. Saying "To my children, per stirpes," means that if one of your children pre-deceases you, his or her share of policy proceeds will pass to his or her children. If you instead say, "To my children, per capita," and one of your children pre-deceases you, that deceased child's share will be divided among your other children who survive you.

3. Provide the insurance company with as much information as possible about your beneficiaries

When you complete your beneficiary designation or beneficiary change forms for your life insurance or annuities, you will need to provide identifying information about your beneficiaries. When you name individuals, you'll generally need to provide their names, addresses, birth dates, social security numbers, and sometimes telephone numbers and relationship to you. Providing this information is important so the insurance company can confirm it is paying out policy proceeds correctly.

4. Make sure your beneficiaries know about the policy (or will be able to find out about the policy when you die)

You should also make sure that your named beneficiaries know that they are named on the policy, or alternatively, that your estate executor or personal representative knows about the policy. Insurance companies have a limited obligation to try to locate beneficiaries and pay policy proceeds. When your beneficiaries know about the policy, they can proactively contact the insurance company after you die.

5. Take advantage of the option of naming a beneficiary so proceeds avoid probate court

One benefit of being able to name a policy beneficiary is that proceeds pass to the beneficiary outside of probate court when you die. While you can name your estate as the beneficiary, doing so means the proceeds may be tied up in the estate administration process before they can be distributed. Naming one or more people or organizations directly can help eliminate unnecessary time and expense in paying out policy proceeds.

What not to do when naming a beneficiary

1. Don't assume that your will or trust supersedes your beneficiary designation

Life insurance and annuity beneficiary designations take precedence over wills and trusts. That means that, regardless of what your will or trust agreement says, your policy proceeds will be paid to the beneficiary on file with the insurance company. If you update your estate planning documents, you should review and update your beneficiaries too.

2. Don't just name a primary beneficiary

It's important to name one or more primary beneficiaries, but you may also want to take advantage of the opportunity to name contingent beneficiaries. You can generally name secondary and even tertiary beneficiaries, so if the first-named beneficiary does not survive you, policy proceeds can be paid to the next person in line, without having to go through probate court.

3. Avoid naming minors as direct beneficiaries

If you want to leave policy proceeds to one or more minor children, think twice before naming them directly as policy beneficiaries. That's because, if you die while they are still minors, the court will have to appoint a guardian to manage the assets for them before the proceeds will be distributed. That process can be time-consuming and frustrating. You could instead name the child's legal guardian, name a custodian, or name a trust created for your children's benefit. Talk to an estate attorney to learn more about these options.

4. Don't unintentionally disqualify a loved one from receiving other benefits

You should also be cautious about naming someone with special needs as a direct beneficiary of your policy. Some government programs including Social Security (SSI) and Medicaid are needs-based, meaning the amount of income and assets the recipient can have is limited. An estate attorney can help you determine if a Special Needs Trust or another solution would help you meet your goals without jeopardizing your loved one's eligibility for benefits.

5. Don't assume you can disinherit your spouse by naming someone else as the life insurance beneficiary

Understand that if you live in a community property state and are married, you cannot name someone other than your spouse as your policy beneficiary without your spouse's consent. Some insurance companies require spousal acknowledgement even for people living in other states.

The bottom line

You can trust Symmetry Financial Group to help you protect what's most important to you!

At Symmetry Financial Group, our goal is to protect you and your loved ones - no matter what changes life has in store for you. To learn more about the insurance solutions we offer and for more tips on making the most of your policy beneficiary designations, contact us online.