When it comes to your employer sponsored benefits, open enrollment season is a great time to take another look at your options to see if there are any areas where you could save money. If you are fortunate enough to have access to employer benefits like health and life insurance coverage, we have a few tips to help you find the best options for your budget.

Strategize savings with an HSA

Health insurance is the most significant benefit that you will use most often. Even if you always select the same coverage, now is a great time to take a closer look at your health insurance options, especially in considering a

Health Savings Account (HSA)

.

Selecting an HSA could help you put pre-taxed deductible funds into a savings account where your money can grow tax-free, which could be a big perk when it comes to retirement savings. The odds are pretty good that your employer offers the HSA benefit: The Society for Human Resource Management (SHRM)

2018 Employee Benefits survey

found that 56% of surveyed members offered their employees an HSA, up from 45% in 2014. Additionally, 37% of employers contributed to their employee HSA’s, up from 30% in 2015.

If you are interested in this benefit, your HR team can help you determine if your employer offers this coverage and help you take next steps.

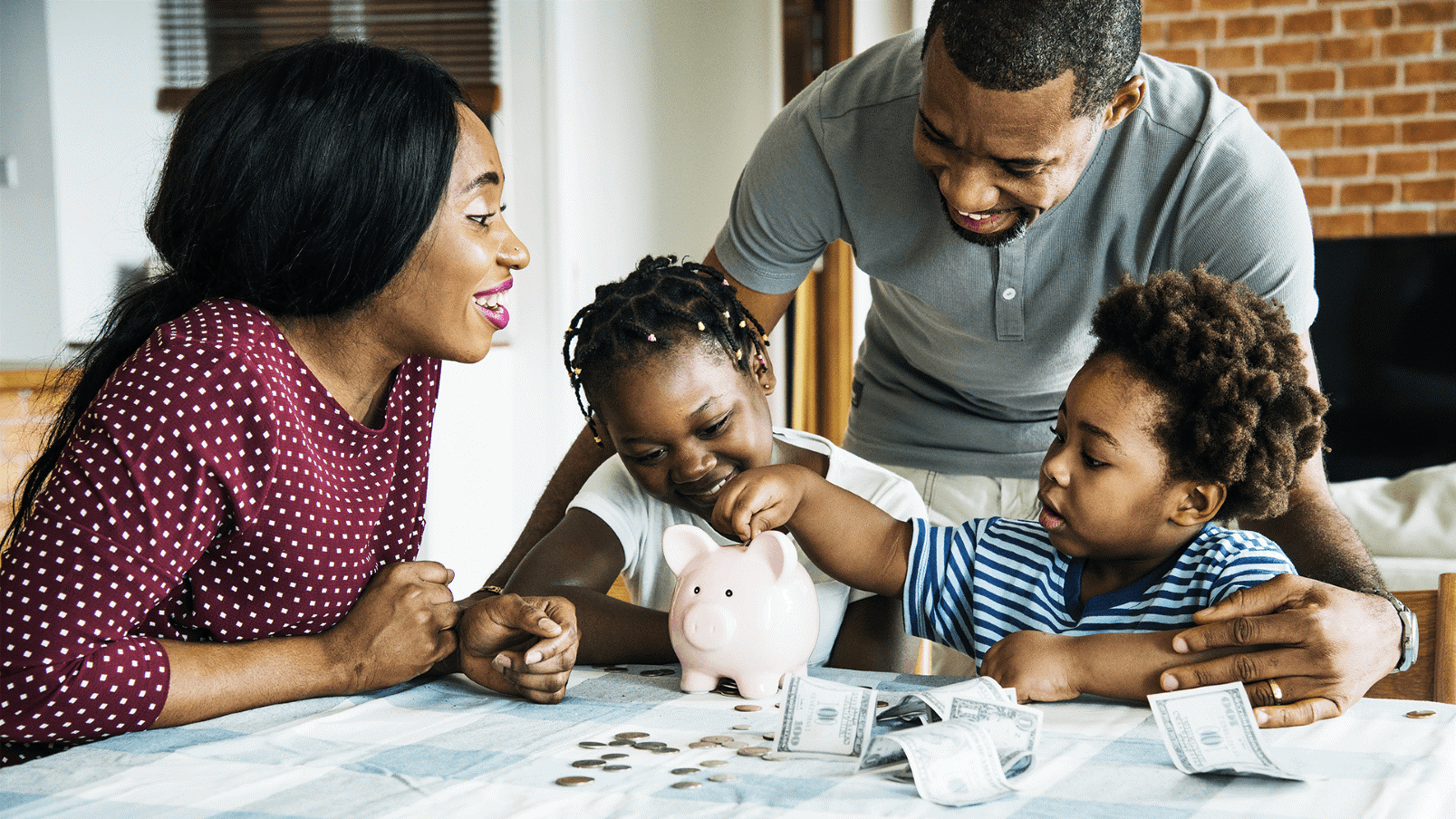

Think twice about group life insurance

If your employer offers a group life insurance plan, you might want to pause before opting into the plan. Group life insurance offers a base level of protection with little to no underwriting, so signing up for coverage is usually quick and easy, but there are some downfalls. Most employers provide a standard plan with coverage up to $50,000; odds are this amount won’t be enough to provide financial protection to your loved ones if you were to pass away unexpectedly.

Instead of a group life insurance plan, consider getting your own term life insurance where you can likely score lower premiums, a term length of your choice, and add-on riders for critical illness or return of premium features. A personal

term life insurance policy

can be a cheaper and more protective replacement for life insurance through work — and the best part is that your policy will travel with you if you end up changing jobs.

Build a security net with disability insurance

Did you know that

one in four

20-year-olds will become disabled before reaching age 67? We don’t know what the future holds, which is why having a plan in place can make all the difference if you were to lose your ability to work due to injury or disability.

Some employers offer short-term or long-term disability insurance, which can cover up to 60% of your salary if you are unable to work. Long-term disability benefits have a waiting period of 90 days to six months before benefits kick in, while short-term disability has a waiting period of about a week and covers wages for three to six months.

Disability insurance is a very helpful benefit for expecting mothers. Most short-term policies consider birth to be a disability and some also grant claims for postpartum. If you are planning to become pregnant in the next year (or next few years), disability coverage can offer some income if you miss work due to late-stage pregnancy, complications around the birth, or recovery. In this situation, it might be helpful to

purchase your own disability insurance

policy to ensure your coverage covers things like pregnancy complications, postpartum effects such as depression, and/or recovery periods.

The bottom line

Taking a close look at your options for 2020 ensures that you are prepared for whatever life brings in the year ahead. It only takes a few minutes to examine the amount/cost of employer-sponsored coverage in comparison to other options, but in doing so you might end up saving a good bit of money.

Wondering if you

need life insurance

? Or do you want to enroll in

disability coverage

that can support you through the unexpected? We can help!

If you’re on the fence about workplace life insurance, or you want a more robust policy to protect your loved ones,

connect with a Symmetry Financial Group agent

today: We provide free consultations on life insurance and disability plans that could save you money in 2020.