Choosing the "Right" Type of Life Insurance

Life insurance helps protect your loved ones by providing financial help to pay for

final expenses

, debts and funds that can help make up for your lost income if you die prematurely.

When it comes to choosing what type of life insurance policy to buy, you have options. Some of the most common choices are

term insurance

, permanent or whole life insurance and

universal life coverage

. While each of these types of insurance is designed to pay a death benefit to your named beneficiaries after you die, there are some important differences you should understand before choosing a policy.

Term Life Insurance

When you purchase term life insurance, you're essentially renting coverage for a set period of time. If you buy a 20-year term insurance policy with a face value of $50,000, and if you pass away 15 years later, the policy will pay $50,000 to your named beneficiary, assuming you kept the policy in force by paying your premium payments when due. If your death instead occurred 21 years after buying a 20-year term policy, there would be no death benefit paid because the policy term expired.

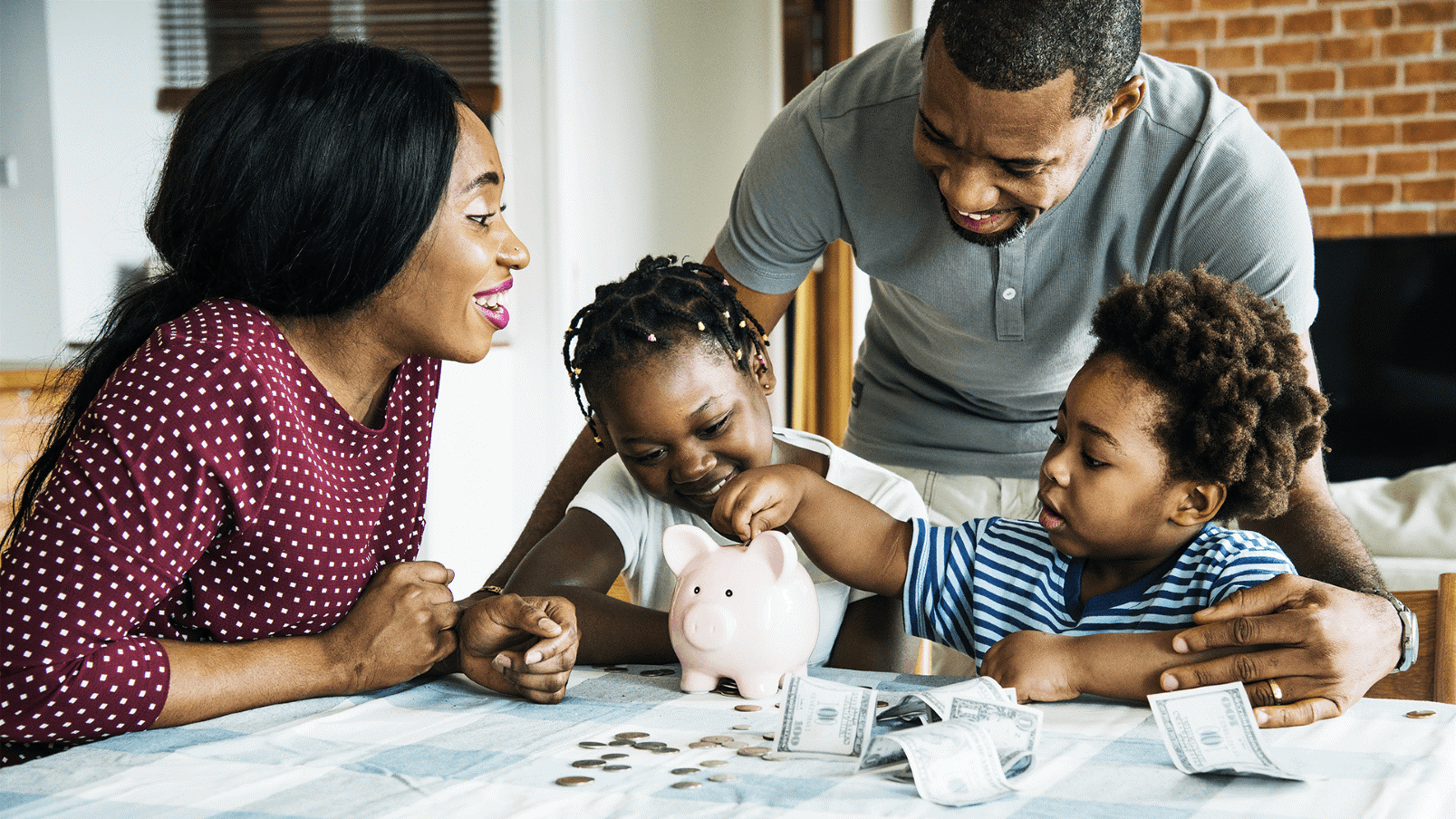

Term insurance is the least expensive option for buying life insurance and it's often used to fulfill part of clients' insurance needs to provide a greater death benefit in the event of premature death. It can be used to provide funds to pay off a mortgage, fund children's college education, or for any other reason. Often, those types of reasons won't apply anymore at the end of the policy term, so it's okay if that coverage isn't there.

Whole Life Insurance

Whole life insurance, or permanent insurance, is coverage designed to be in force throughout your entire lifetime, or up to a predetermined policy maturity date (usually age 100). As long as you pay your premium each month to keep the policy active, the insurance company will pay the face amount of the policy to your named beneficiaries. Your premium amount is based on your age and health when you take out the policy, and will remain fixed.

Whole life insurance is often used to provide funds for funeral/burial expenses, to pay off debts, to fund business buy/sell agreements and for estate planning purposes.

Universal Life Insurance

Universal life insurance, sometimes referred to as "cash value" life insurance, is similar to permanent insurance: as long as the cost of insurance is paid, the policy will remain in effect until you die, or until the policy maturity date.

When you pay premiums for universal life coverage, a portion of your premium goes to pay the cost of insurance and a portion goes to fund the policy's "cash value." That cash value amount is credited with interest and policyholders can borrow against it or take withdrawals from it as needs arise over time. Because of the policy's cash value component, universal life insurance policies also have some flexibility when it comes to paying premiums. If you are unable to make your premium payment for a given quarter, your policy may still be able to remain active if there is sufficient cash value within the policy to pay the cost of insurance.

People choose universal life coverage most of the same reasons they choose term or permanent life insurance, including paying debts and final expenses, providing estate liquidity and providing funds for surviving family members after the policyholder's death.

Symmetry Financial Can Help You Find the Best Life Insurance for Your Needs

There are variations on each of these types of policies and there are also other options available, but these represent the most common types of policies. The right type of coverage for you will depend on your personal financial situation, what other policies you have in place, your goals and reasons for purchasing life insurance.

Don't let the different choices be overwhelming; you don't have to make a decision about buying life insurance all alone. The insurance professionals at Symmetry Financial Group are here to help. With access to insurance products offered by more than 30 different insurance carriers, we are truly independent and can therefore help you find coverage for your unique needs.

We'll take the time to understand your needs and goals and will work with you to find you coverage designed to meet both those needs and your budget. To learn more,

contact us online

today, or call us at (877) 285-5402.