There is a cost associated with purchasing any type of insurance product. However, not purchasing insurance coverage can prove to be far more costly. Here are just some of the reasons why everyone should consider buying life insurance, disability income insurance, and critical illness coverage.

Risks of Not Buying (Enough) Life Insurance

Where most other types of insurance products are designed to protect your bottom line,

life insurance

is designed to benefit others. The primary reason for purchasing life insurance coverage is to provide a ready source of liquid funds payable to your named beneficiaries after your death - Protecting their own finances or creating a legacy for future generations.

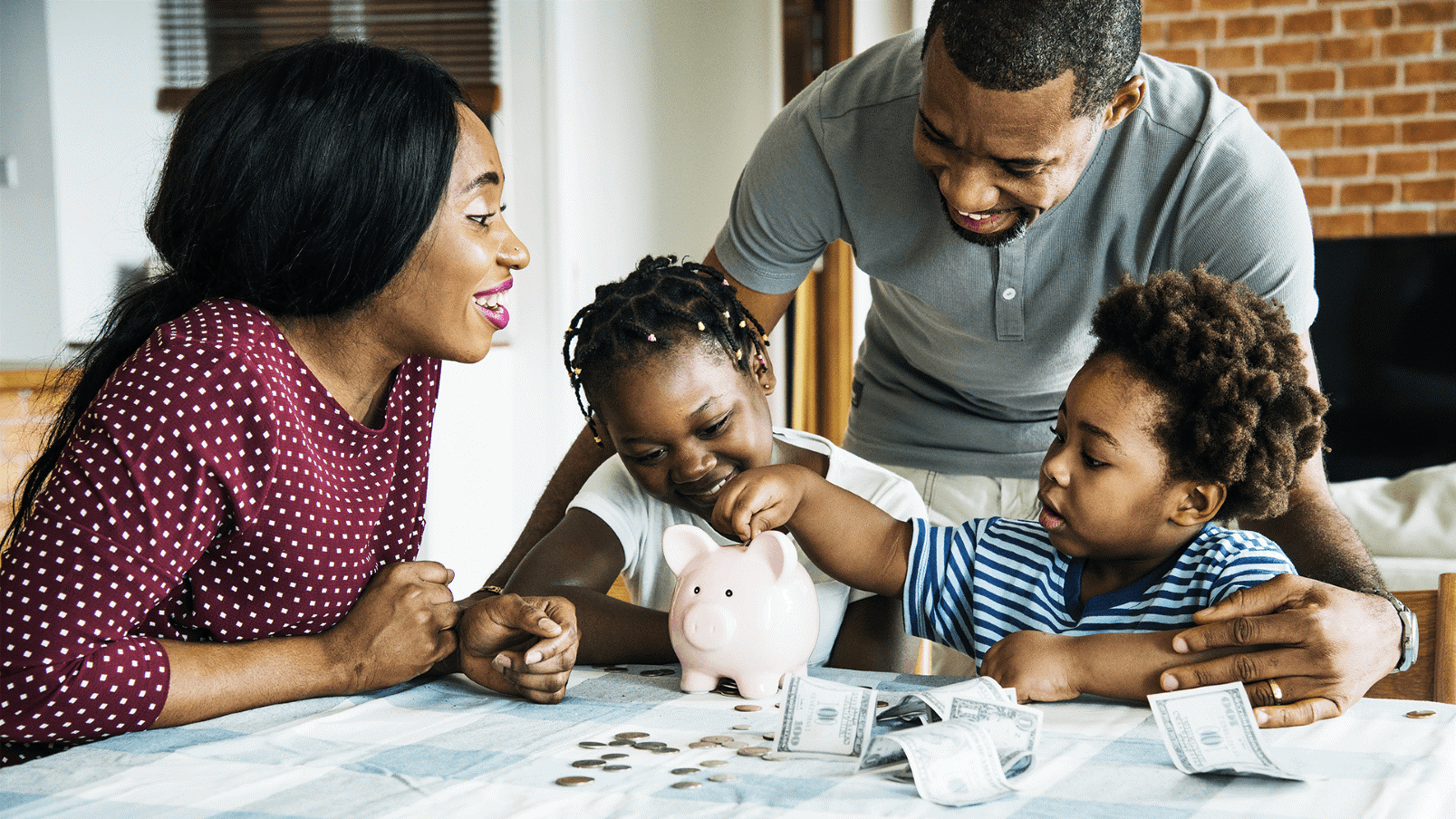

The reality is that we are all going to die someday. If you have adequate life insurance coverage when that happens, your loved ones won't need to worry about where to find the funds needed to pay your final expenses, including a funeral or memorial service and cremation or burial of your remains.

Beyond final expenses, not having life insurance coverage could also mean that your family would be uprooted while they are still grieving, forced to change their standard of living, simply because your income stopped. Without life insurance proceeds to pay off debts and help with regular monthly expenses, your loved ones might struggle to get by.

Risks of Being Uninsured When Disability Strikes

Becoming disabled is also a very real possibility for all of us. In fact, according to the

Social Security Administration

, one in four of today's 20-year olds will become disabled before reaching retirement age.

Disability income insurance

is designed to provide a safety net to help disabled workers continue to meet their financial obligations. Without it, medical bills can quickly pile up in addition to regular financial obligations, adding unneeded stress.

While most workers are covered by Social Security's Disability programs, it can be a difficult and time-consuming process to apply for and receive benefits, taking years in some cases. In addition, the federal Social Security Disability program relies on an "any occupation" definition of disability, meaning you would need to be unable to perform the duties of any job you would otherwise be qualified to hold, in order to qualify for benefits. In contrast, many private disability income policies use an "own occupation" standard, which can make the process of proving your disability faster and easier.

Failing to purchase disability income coverage now, while you are healthy and able to do so, could mean you and your loved ones would struggle financially in the event of an unforeseen disability.

Risks of Being Diagnosed with a Critical Illness Without Critical Illness Coverage in Place

Finally, none of us knows when a serious illness like cancer will strike, or when a heart attack or stroke will leave us fighting to regain our health.

Critical Illness insurance

is coverage designed to pay a lump sum cash benefit to help ease the financial strain of your diagnosis.

Health insurance policies may require you to meet high deductibles before coverage begins, or may not cover treatments they deem experimental or the expenses associated with traveling to receive care. If you don't have a critical illness policy, the impact of becoming ill can wreak financial havoc on your life, at a time when you and your family are already dealing with emotional and physical stress.

Buying critical illness coverage can provide peace of mind, knowing that you will have the funds you need for such expenses if you are diagnosed with a critical illness or experience a covered health event.

Let Symmetry Financial Group Help You Avoid the Risks of Being Uninsured

Going without insurance coverage could mean financial struggles for you and your loved ones if an unforeseen disability or critical illness occurred, and financial challenges on top of grief if you were to die prematurely without insurance protection.

At

Symmetry Financial Group

, our independent insurance agents help people protect their finances, and their loved ones' financial future, from the risks of death, disability and critical illnesses, every day. To learn how affordable and easy it can be to purchase coverage, contact us today

online

or call us at (877) 285-5402.