Many young people assume they don’t need life insurance, or that they should wait to purchase coverage until their lifestyle or family situation changes. However, waiting to buy life insurance can be a costly mistake.

In reality, the best time to get life insurance is when you’re an infant.That’s because the cost of insurance is largely based on your age. In addition to premium hikes related to your age, there’s another potential hazard of waiting to buy life insurance. Over time, you run the risk that you will develop a serious or chronic health condition. If that happens, you could be unable to obtain coverage at all, or your premium payments could be so high that you wouldn’t be able to afford to keep the policy in place.

Of course, not all of us are lucky enough to have life insurance coverage from a young age. If your parents didn’t buy life insurance for you right after you were born, there’s no time like the present. You will never again be as young as you are today.

Why You Need Life Insurance at Your Current Age

You probably already know that life insurance is designed to pay the policy’s “death benefits” after you die. This means you’re not buying life insurance for yourself; after all, you won’t be around to benefit from the death benefit payout.

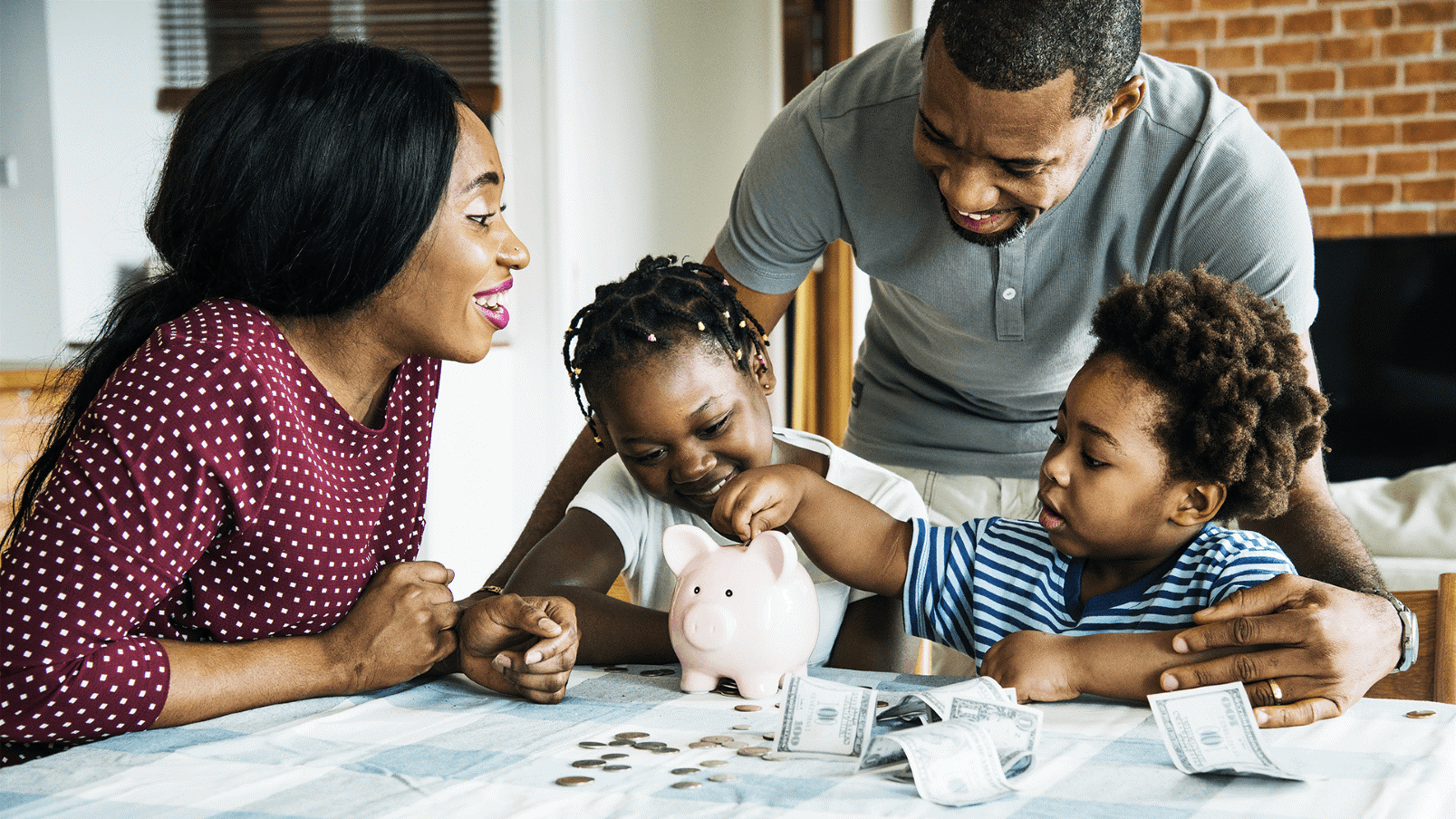

Protect Loved Ones from Potential Financial Stress

If you have people who you support, loved ones who could be hurt financially if you died prematurely, it’s easy to understand why you need life insurance. Upon your passing away, life insurance benefit payments could help make up for their lost income, allowing your loved ones to continue their current standard of living and continue meeting financial obligations. As discussed above, it generally doesn’t make sense to put off buying coverage when it will likely be cheaper now.

Even if you’re single now and don’t have anyone who depends on your income today, that doesn’t mean that will be the case for your entire lifetime. If you were to die prematurely, would your loved ones have the necessary funds to pay for your final expenses? What about paying off debts? Life insurance can play a valuable role in helping ensure you don’t inadvertently saddle family members with financial obligations when you die.

Protect Your Future Insurability

None of us knows what the future holds in store in terms of our own health. Deciding to wait to buy life insurance could backfire if your health takes a turn for the worse. Buying a universal life policy now means you should have insurance protection for your entire lifetime, as long as you maintain the policy by making regular premium payments.

Buying Cash Value Life Insurance Earlier Can Have Long-Lasting Benefits

Besides providing tax-free death benefit payments to your named beneficiaries and protecting your insurability, there are other compelling reasons to buy universal life insurance for yourself at your current age, or to buy a policy for a young child.

Both

term insurance

and

universal life insurance

policies provide insurance payments to policy beneficiaries when the policyholder dies. However, universal life insurance has an additional component that term policies don’t offer: a cash value account right inside the policy. Premium payments for universal life policies are typically higher than those for term policies with the same death benefit because the amount of premium includes both payment for the cost of insurance and additional funds that go into the cash value account.

The cash value grows, tax-deferred, and earns competitive interest rates with the minimum rate specified in the policy. Having the cash value inside the policy can give you flexibility with your premium payments. If you have unexpected expenses one month, you may be able to skip your life insurance premium payment entirely, relying on your cash value. You can also borrow against the accumulated cash value or withdraw funds if you need them.

Let Symmetry Financial Group Help Protect You – Whatever Your Current Age

What’s the best age to buy life insurance? Your current age. The Independent Insurance Agents at Symmetry Financial Group will work closely with you to help you determine your insurance needs, goals, and budget. With access to dozens of well-known, reputable insurance companies, our insurance professionals will help match you to policies designed to meet your needs today – and in the future.

To learn more and to get started,

contact us

today.