Spouses or committed partners often buy life insurance to provide a financial safety net so that funds are available for things like making up for lost income, paying down debt, and caring for minor dependents in the event of a spouse or partner's premature death.

What about people who are single, though? Do they really need

life insurance coverage?

In most cases, the answer is yes. Here are five reasons you may want to consider purchasing coverage even if you are single.

1. Final Expenses

Unless you have set aside additional funds specifically to cover your final expenses, such as the cost of being cremated or buried, you may need life insurance to provide a benefit for these purposes. If you don't buy life insurance and haven't set aside sufficient assets to cover these types of costs, you may cause a significant (and unwelcome) burden on your next of kin, who will have to shoulder these expenses themselves.

Your independent insurance agent can give you estimates for these types of costs in your area to use as a starting point when you determine how much life insurance to obtain.

2. Pay Debts

If you have a mortgage loan, credit card debt, a car loan, private student loans, medical expenses, or any other type of financial obligation that's not automatically forgiven when you die, life insurance can serve as a resource to pay off these debts. Providing a source of payment for these expenses can help make sure you don't die leaving an "insolvent estate" and can remove the burden from your next of kin's shoulders.

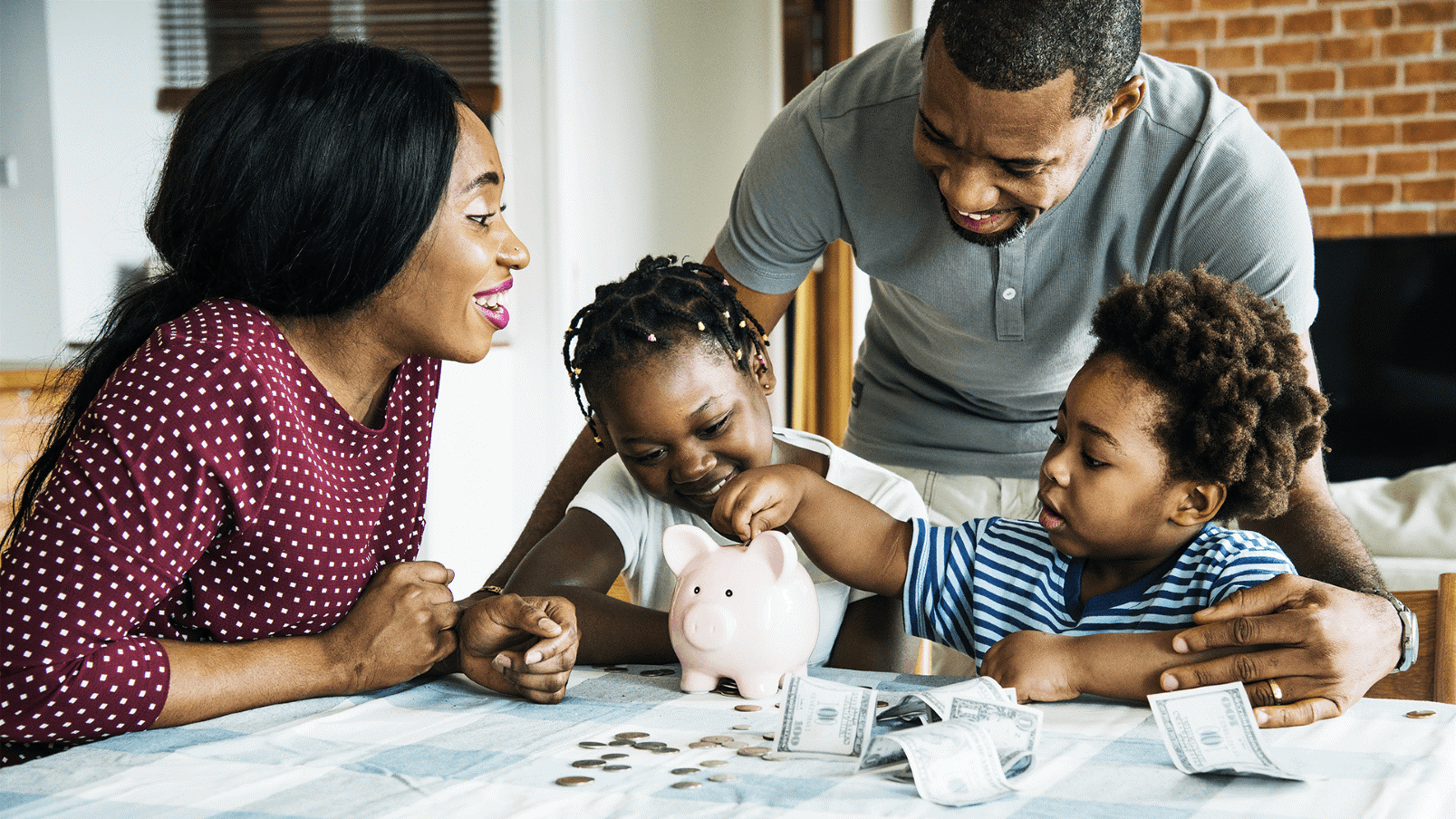

3. Provide for Today's Dependents - and Tomorrow's

Single people who have one or more minor dependents, or who are caring for/ financially providing for parents, grandparents, or other loved ones, may need the protection life insurance can offer. If you were to die prematurely, your life insurance policy could provide funds for continued care.

If you don't have financial dependents today but anticipate that you may at some point in the future, buying life insurance now can ensure you have the coverage you need - whenever you need it.

4. Leave a Legacy

Many single people are passionate about being philanthropic and are charitable-minded, volunteering their time and talents and making financial contributions during their lifetimes to the causes that matter most to them. Life insurance can be a wonderful way to create a legacy for those causes you care about, helping non-profits carry on with their charitable missions long after you have passed away.

5. Protect Your Insurability

Finally, remember that buying life insurance will likely never be cheaper for you than it is right now. That's because the costs of coverage are based, in large part, on your attained age and health status.

When you purchase coverage now, you're not only locking in a lower premium, you're also protecting your right to buy coverage, in case your health changes as time goes by. If you later decide to have children or get married and want to provide for your dependents, you can have the peace of mind that comes from knowing you've protected your insurability.

Let Symmetry Financial Group Help With Your Insurance Needs

Whatever your reasons are for buying life insurance, and whatever your coverage needs are, your

Symmetry Financial Group

independent insurance agent can help. At Symmetry Financial Group, we are not just trying to sell you an insurance policy. Instead, we will take the time to get to know you, and understand what your ultimate goals are. We'll explore your situation and goals today, and we'll talk about what the future might bring. Finally, we will take the time to answer your questions, explain how various types of insurance coverage work, and help you understand how affordable life insurance coverage can be.

As an independent provider, we have access to dozens of the country's most well-known insurance companies. That means we can help you find a policy that we believe will meet your needs, goals

,

and budget.

To learn more about buying life insurance as a single person,

contact us online

today, or call us at (877) 285-5402.